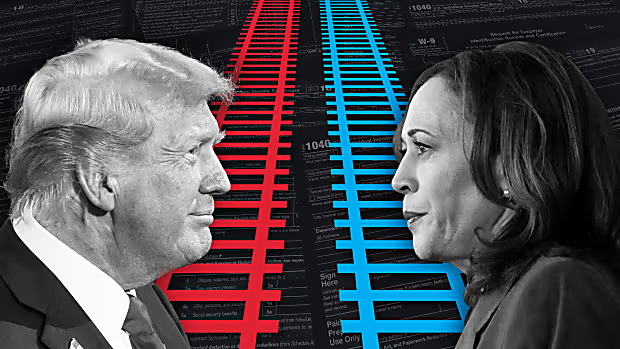

As we approach the 2024 U.S. Presidential Election, proposed tax policies could significantly affect your financial situation. Both parties offer different approaches that could impact income taxes, capital gains, and family tax credits. Here’s how the election could influence your tax strategy:

1. Changes to Income Tax Rates

Both major candidates propose different tax strategies for individuals and businesses:

- Democrats may raise the top marginal tax rate from 37% to 39.6% for those earning over $400,000, following the Biden administration’s tax plans[Fidelity], [TowerPoint Wealth].

- Republicans will likely extend the provisions from the Tax Cuts and Jobs Act (TCJA), keeping the top tax rate lower and providing tax relief to middle-income earners[Morgan Stanley].

2. Capital Gains and Investment Taxes

- Harris proposes raising capital gains taxes on those earning over $1 million annually, taxing gains at ordinary income rates[Crowe], [TowerPoint Wealth].

- Trump is expected to maintain low capital gains taxes, encouraging continued investments[Fidelity].

3. Corporate Tax Rates

- Harris proposes increasing the corporate tax rate from 21% to 28%, raising revenue from large corporations[Morgan Stanley], [Fidelity].

- Trump aims to reduce the corporate tax rate to 20%, offering businesses more opportunities to grow and invest[Crowe].

4. Family-Related Tax Benefits

- Harris supports expanding the Child Tax Credit, potentially increasing the maximum credit to $3,600 per child[TowerPoint Wealth].

- Republicans may look to maintain the current credit levels introduced by the TCJA[Morgan Stanley].

5. Estate and Gift Taxes

- Under Democrats, the estate tax exemption could be reduced from $13.61 million to around $5 million, potentially impacting estate planning for high-net-worth individuals[Fidelity], [Crowe].

- Republicans are likely to support maintaining or expanding the current exemption levels introduced by the TCJA[Morgan Stanley].

Conclusion

The 2024 election may result in significant changes to tax policies, from income tax rates to corporate and estate taxes. Whether you’re an individual taxpayer, a business owner, or an investor, it’s important to stay informed and adapt your tax strategies accordingly.

Consult with a tax professional to navigate potential changes and make sure your financial plans are prepared for future tax reforms.